Table of Content

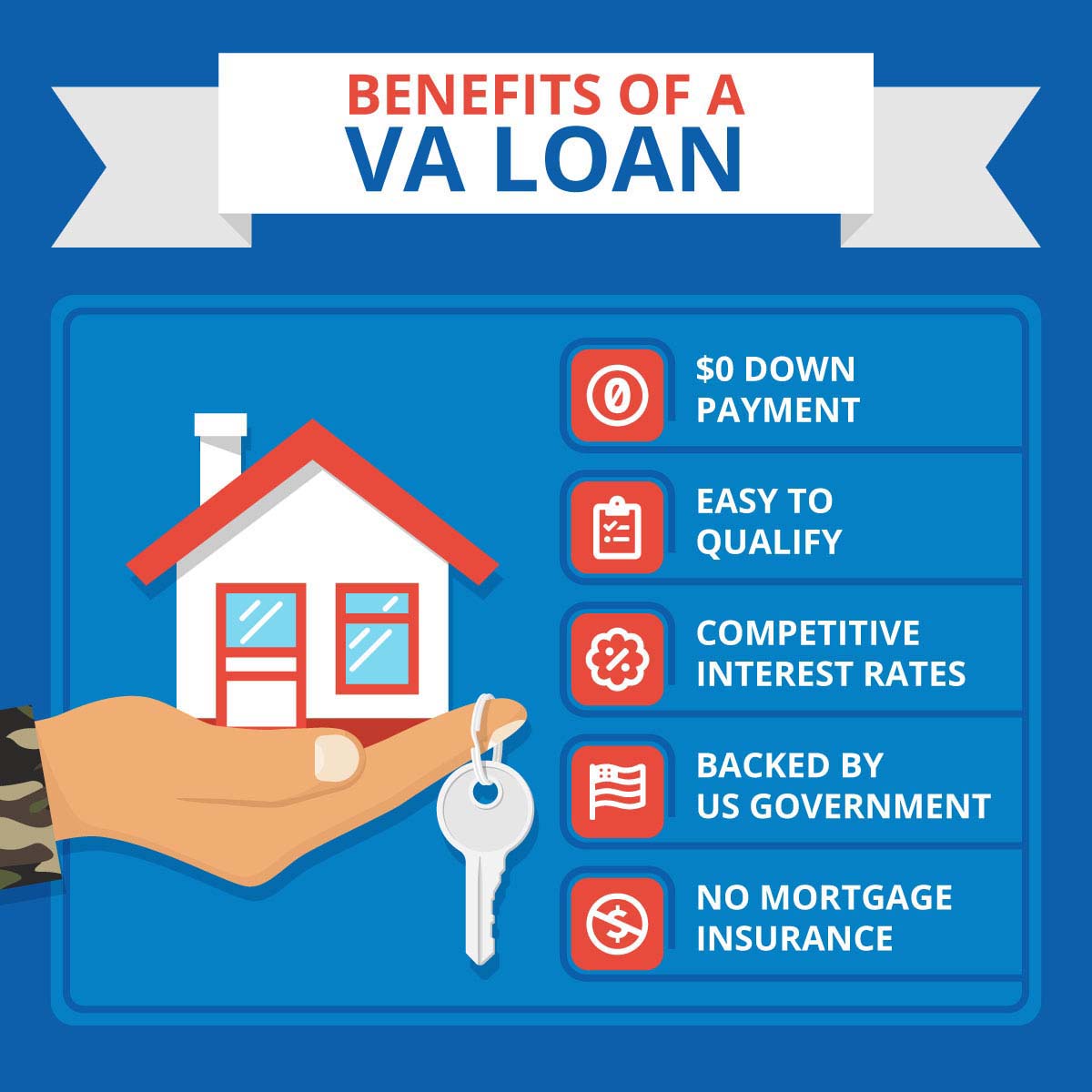

Bank of England Mortgage offers affordable, easy-to-understand VA Home loans in recognition of the contributions and sacrifices veterans have made for America. Huntsville's median listing price comes in at 0% of the national average. Huntsville's median listing price comes in at 95% of the national average. We offer confidential help for Veterans, service members, and their families at no cost in a non-medical setting. Our services include counseling for needs such as depression, posttraumatic stress disorder , and the psychological effects of military sexual trauma .

VA Loans made prior to March 1, 1988 can be assumed with no qualifying of the new buyer. If the buyer defaults the property the Veteran homeowner may be liable for the funds. Surviving spouse of an eligible Veteran who died resulting from service, and has not remarried. Our optometrists offer you routine eye exams, preventive vision testing and treatment for conditions like glaucoma. We also provide prescriptions for eyeglasses and other assistive devices.

Alabama Title Loans, Inc.

Our mission is to simplify the mortgage process so that buying your primary residence, acquiring a vacation home, investing in a property or refinancing an existing loan is totally stress-free. Typically, when you are searching for a home the listing agent will ask for a pre-qualification letter. A pre-qualification is when your lender reviews your income, assets, and credit. This will give you a head start in the process to finding a new home.

You don’t have to be enrolled in VA health care or have a service-connected disability. We provide private organizations and community agencies education on our Veteran community and military culture. Together, we build referral networks to expand support for Veterans, service members, and their families.

Apply For Va Home Loan Assistance

Call our Veterans Crisis Line at 988 and press 1 to get support anytime day or night. Our Vet Center can also connect you with ongoing counseling and services. If you have symptoms of PTSD after a traumatic event, we can help. We offer assessment and support through private counseling and group therapy.

Their average total fees are $4,176, which is $1,452 lower than the next largest lender, Mortgage Research Center, LLC. Huntsville's average VA mortgage closing costs are $5,411. The top Huntsville VA lender as defined by loan originations is QUICKEN LOANS, LLC, with 414 VA loans originated. Their average total fees are $4,753, which is $2,439 higher than the next largest lender, FREEDOM MORTGAGE CORPORATION.

How VA Loans Work in Alabama

Our outpatient clinic provides primary care and specialty health services, including mental health services, vision care , treatment for hearing loss , women’s health services, and more. Below, you’ll find our address and hours, parking and transportation information, and the other health services we offer at our Huntsville VA Clinic. If you don’t qualify for a Huntsville VA loan or VA refinance, consider an FHA Loan. These government backed loans offer low interest rates, low down payment requirements of just 3.5% and are a great option if you have little or poor credit history. Our services are also available to family members when their participation would support the growth and goals of the Veteran or active-duty service member.

To enter and activate the submenu links, hit the down arrow. You will now be able to tab or arrow up or down through the submenu options to access/activate the submenu links. You may be eligible for a property tax exemption in Alabama if you are 100 percent disabled as a result of service. By using, you will be matched with participating members of the ICB Solutions network who may contact you with information related to home buying and financing.

Women Veteran care

Contact us to schedule, reschedule, or cancel your appointment. If a referral is required, you’ll need to contact your primary care provider first. The top Huntsville VA lender as defined by loan originations is FREEDOM MORTGAGE CORPORATION, with 9 VA loans originated.

Department of Veterans Affairs can be obtained without a down payment. We’ll help you clearly see differences between loan programs, allowing you to choose the right one for you whether you’re a first-time home buyer or a repeat buyer. Our records can’t be accessed by other VA offices, the DoD, military units, or other community networks and providers without your permission or unless required to avert a life-threatening situation. Here, you can be as open as you want—there’s absolutely no judgment.

These members typically have paid to be included but are not endorsed by ICB Solutions, LLC or this site. The county has a population of 346,892 (est.) and about 34,377 veterans live there. Accept deposits or trust accounts and is not licensed or regulated by any state or federal banking authority. Sellers are often asked to pay a portion of closing costs and therefore less likely to negotiate the sales price of the home. Bank of England Mortgage is an equal opportunity employer and encourages women, minorities, persons with disabilities, and veterans to apply. The lender will order a VA appraisal by an expert that works with the Department of Veteran's Affairs to inspect and appraise the home to make sure it meets VA minimum property requirements or VA MPR.

By submitting your information you agree Mortgage Research Center can provide your information to one of these companies, who will then contact you. Neither Mortgage Research Center nor ICB Solutions guarantees that you will be eligible for a loan through the VA loan program. VALoans.com will not charge, seek or accept fees of any kind from you. Mortgage products are not offered directly on the VALoans.com website and if you are connected to a lender through VALoans.com, specific terms and conditions from that lender will apply. The Veteran Administration’s Loan originated in 1944 through the Servicemen’s Readjustment Act; also know as the GI Bill. It was signed into law by President Franklin D. Roosevelt and was designed to provide Veterans with a federally-guaranteed home loan with no down payment.

We can also refer you to VA or community counseling for treatment and therapy resources. Homeownership in Alabama is a dream for many people, but not everyone has access to a loan program as great as the VA home loan. So whether you are looking to settle down in the bustling city or on the ocean shoreline, you’ll be thrilled with your new home. We’re here to assist home buyers in Alabama at every step of the way.

We’re here to make the VA home loan process easier, with tools and knowledge that will help guide you along the way, starting with our VA Loan Qualifier. Our eligibility page is a great place to learn more about VA mortgages and VA mortgage refinancing eligibility. The Huntsville, Alabama economy is a strong with unemployment well below the national average. The average yearly salary of an employee in Huntsville is $66,000. If you’re a Huntsville Veteran who wants to buy a home you’ve come to the right place!

No comments:

Post a Comment