Table of Content

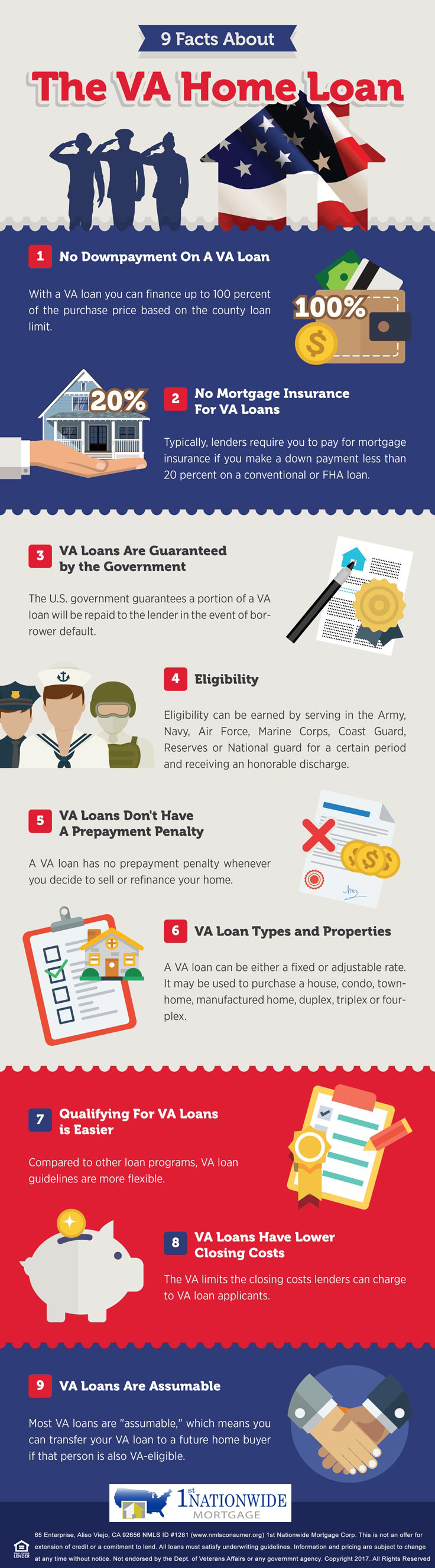

YP - The Real Yellow PagesSM - helps you find the right local businesses to meet your specific needs. Search results are sorted by a combination of factors to give you a set of choices in response to your search criteria. “Preferred” listings, or those with featured website buttons, indicate YP advertisers who directly provide information about their businesses to help consumers make more informed buying decisions. YP advertisers receive higher placement in the default ordering of search results and may appear in sponsored listings on the top, side, or bottom of the search results page. At least 181 days of continuous active duty with no dishonorable discharge. If you were discharged earlier due to a service-related disability you should contact your Regional VA Office for eligibility verification.

We can also refer you to VA or community counseling for treatment and therapy resources. Homeownership in Alabama is a dream for many people, but not everyone has access to a loan program as great as the VA home loan. So whether you are looking to settle down in the bustling city or on the ocean shoreline, you’ll be thrilled with your new home. We’re here to assist home buyers in Alabama at every step of the way.

Fixed Rate Mortgages

VALoans.com is a product of ICB Solutions, a division of Neighbors Bank. ICB Solutions partners with a private company, Mortgage Research Center, LLC (NMLS #1907), that provides mortgage information and connects homebuyers with lenders. Neither VALoans.com, Mortgage Research Center nor ICB Solutions are endorsed by, sponsored by or affiliated with the Dept. of Veterans Affairs or any other government agency. ICB Solutions and Mortgage Research Center receive compensation for providing marketing services to a select group of companies involved in helping consumers find, buy or refinance homes. If you submit your information on this site, one or more of these companies will contact you with additional information regarding your request.

Department of Veterans Affairs can be obtained without a down payment. We’ll help you clearly see differences between loan programs, allowing you to choose the right one for you whether you’re a first-time home buyer or a repeat buyer. Our records can’t be accessed by other VA offices, the DoD, military units, or other community networks and providers without your permission or unless required to avert a life-threatening situation. Here, you can be as open as you want—there’s absolutely no judgment.

How to get a VA Loan in Alabama

We’re here to make the VA home loan process easier, with tools and knowledge that will help guide you along the way, starting with our VA Loan Qualifier. Our eligibility page is a great place to learn more about VA mortgages and VA mortgage refinancing eligibility. The Huntsville, Alabama economy is a strong with unemployment well below the national average. The average yearly salary of an employee in Huntsville is $66,000. If you’re a Huntsville Veteran who wants to buy a home you’ve come to the right place!

If you are a spouse of a service member who died in the line of duty or as a result of a service-related disability. Many localities in the region provide other van services to Veterans. We work with Disabled American Veterans and county Veterans Affairs directors to provide transportation for Veterans and authorized caregivers to get to scheduled medical appointments.

Resources

Bank of England Mortgage offers affordable, easy-to-understand VA Home loans in recognition of the contributions and sacrifices veterans have made for America. Huntsville's median listing price comes in at 0% of the national average. Huntsville's median listing price comes in at 95% of the national average. We offer confidential help for Veterans, service members, and their families at no cost in a non-medical setting. Our services include counseling for needs such as depression, posttraumatic stress disorder , and the psychological effects of military sexual trauma .

VA helps Servicemembers, Veterans, and eligible surviving spouses become homeowners. As part of our mission to serve you, we provide a home loan guaranty benefit and other housing-related programs to help you buy, build, repair, retain, or adapt a home for your own personal occupancy. As of January 1, 2020, VA borrowers in Alabama with their full VA loan entitlement are not restricted by VA loan limits. This means you can borrow as much as a lender is willing to lend without needing a down payment. VA borrowers in Alabama should also consider the cost and impact of VA loan limits and property taxes when making their home purchase.

The VA loan was designed to offer long-term financing to eligible American veterans or their surviving spouses . VA loans are made by private lenders and guaranteed by the Department of Veterans Affairs. Because private lenders make the loans and not the VA, you need to find a lender licensed in the state you plan to purchase or refinance. Your VA primary care provider will work closely with you to plan for all the care you need to stay healthy and well throughout your life, including immunizations and vaccinations.

As of January 1, 2022, VA loan limits for all counties in Alabama are $647,200. However, Veterans without their full VA loan entitlement are still bound to Alabama’s VA loan limits. For example, if you're purchasing a home in Gulf Shores, AL, you'll need to find a lender licensed in Alabama to do the loan. Not affiliated with Dept. of Veterans Affairs or any government agency. Some sellers are hesitant to work with someone obtaining a VA Loan because it takes longer than a conventional loan to process.

Our mission is to provide transparency in mortgage lending. We report statistics on every mortgage lender that we can collect data on-- not just those who pay for inclusion. We source our data from authoritative sources, and ensure to the best of our abilities that it is accurate. The below table looks at the average fees/closing costs and rates for VA 30 Year Fixed Rate mortgages originated by each lender at the Huntsville level.

They will also work with family members or caregivers who support you. If you’re struggling with issues like PTSD, depression, grief, anger or trauma, we offer counseling and other support. You may qualify even without enrolling in VA health care. If you’re already a homeowner you can refinance your mortgage into a Huntsville VA Loan refinance. Cash-out refinancing or streamline refinancing are available, depending on your needs. A VA loan refinance can save you money on interest rates and lower your monthly mortgage payment.

Their average total fees are $4,176, which is $1,452 lower than the next largest lender, Mortgage Research Center, LLC. Huntsville's average VA mortgage closing costs are $5,411. The top Huntsville VA lender as defined by loan originations is QUICKEN LOANS, LLC, with 414 VA loans originated. Their average total fees are $4,753, which is $2,439 higher than the next largest lender, FREEDOM MORTGAGE CORPORATION.

If you experienced sexual assault or harassment during military service, we can help you get the counseling you need. Any Veteran or service member, including members of the National Guard and Reserve forces, who experienced military sexual trauma is eligible to receive counseling. This applies to people of all genders from any service era. A Certificate of eligibility is needed to prove that you qualify for a VA Loan. VA Loans are available to veterans, service members, and spouses.

VA Loans made prior to March 1, 1988 can be assumed with no qualifying of the new buyer. If the buyer defaults the property the Veteran homeowner may be liable for the funds. Surviving spouse of an eligible Veteran who died resulting from service, and has not remarried. Our optometrists offer you routine eye exams, preventive vision testing and treatment for conditions like glaucoma. We also provide prescriptions for eyeglasses and other assistive devices.

We offer couples and family counseling to support you as you work toward meeting your goals. If you’re experiencing financial hardship due to the COVID-19 emergency, you can request a temporary delay in mortgage payments. To access the menus on this page please perform the following steps.

No comments:

Post a Comment